A total of 29 state governors spent ₦1.994tn on recurrent expenditures, including refreshments, sitting allowances, travelling, and utilities in the first nine months of 2024, findings by The PUNCH have shown.

It was also gathered that the states obtained a ₦533.29bn loan, while it spent ₦658.93bn to service its debts owed to local, foreign, and multilateral creditors.

However, these states fell short in their revenue-generating targets, collecting a total sum of ₦1.92tn as internally generated revenue but fell short of the revenue target of ₦2.868tn, recording a deficit of ₦948.28bn.

The recurrent data utilised in this report did not include personnel costs.

An analysis of the fiscal performance of each state, utilizing data from the Q1 to Q3 budget performance reports obtained from each state’s website, revealed a pressing need for stringent measures to prioritise fiscal discipline, especially amidst growing calls to reduce the costs of governance.

This comes despite a 40 per cent increase in the state’s statutory allocations from the Federation Account.

For the first three quarters of the year, our correspondent examined budget implementation data from twenty-nine states; data for six states was not available.

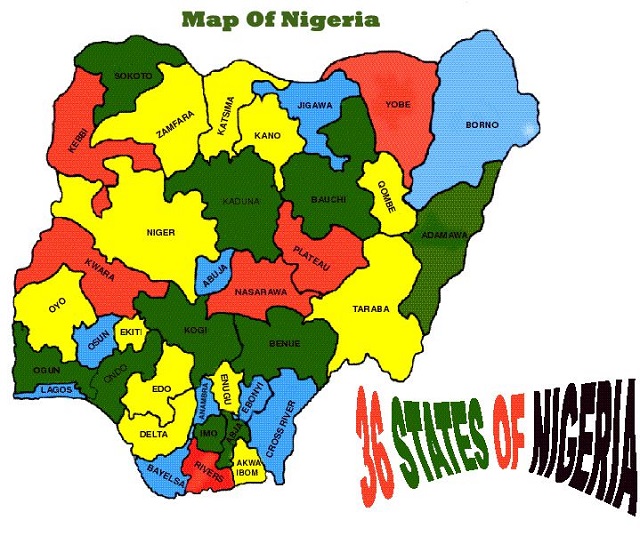

Borno, Gombe, Kaduna, Kano, Kwara, Sokoto, and Ogun states were the ones without the latest data from January to September 2024.

Since the commencement of the current administration, state governments have enjoyed improved monthly allocation mainly due to the elimination of fuel subsidies and the unification of the foreign exchange market.

The Nigeria Extractive Industries Transparency Initiative recently noted that the Federation Accounts Allocation Committee disbursed ₦3.473tn to the three tiers of government in the second quarter of 2024.

This reflects an increase of ₦46.77bn (1.42 per cent) compared to the first quarter of 2024.

The Federal Government received ₦1.102tn, representing 33.35 per cent of the total allocation, while 36 states received ₦1.337tn (40.47 per cent), and the 774 local government councils shared ₦864.98bn (26.18 per cent).

A comparison with the previous quarter shows that the Federal Government’s allocation decreased by ₦41.44bn (3.76 per cent), while state governments saw an increase of ₦58.13bn (4.29 per cent), and local government councils experienced a rise of ₦30.82bn (3.57 per cent).

But this improved funding hasn’t translated to an improved standard of living for its citizens.

A breakdown showed that the 29-state government spent ₦1.994tn on its recurrent expenditure, which included refreshments for guests, sitting allowances to government officials, local and foreign travel expenses, and utility bills.

The general utilities include electricity, internet, telephone charges, water rates, and sewerage charges, among others.

Lagos, Plateau, and Delta States spent the highest on their operating expenses, incurring a cost of N375.19bn, ₦144.87bn, and ₦121.54bn, respectively. This was followed by Ondo and Bauchi spending ₦107.34bn and ₦99.31bn.

Niger State, under the leadership of Governor Mohammed Umar Bago, was the highest borrower within the review period, obtaining loans worth ₦79.09bn. Katsina followed with a loan of ₦72.89bn. Oyo State also got a loan of ₦62.48bn.

In terms of revenue, Lagos State collected the highest of ₦912.17bn, followed by Rivers State with a collection of ₦269.18bn. Third on the list was Delta (₦97.02bn).

A state-by-state analysis revealed that Abia State, led by Governor Alex Otti, spent ₦17.91bn on operating expenses and generated ₦22.15bn in revenue, falling short of the ₦32.14bn revenue target. Additionally, the state borrowed ₦3.901bn and allocated ₦10.91bn for debt servicing.

Adamawa State spent ₦41.45bn on recurrent expenditure, while it earned N9.16bn income out of its revenue of ₦22.24bn. This state borrowed ₦10bn and paid ₦22.68bn to service its debts.

Akwa-Ibom State recurrent spending reached N85.45bn in nine months, ₦43.98bn more than its generated revenue of ₦41.47bn in nine months. The state paid ₦34.47bn as debt service but didn’t borrow.

Anambra State generated more revenue (₦28.296bn) than its recurrent spending of ₦12.70bn. It spent ₦4.56bn on debt service and didn’t record any borrowing.

Lagos issues island residents two-week ultimatum to clean up environment

The Bauchi government spent ₦99.31bn on its operating expenses. This state only got ₦15.92bn out of its budgeted target of ₦37.03bn but borrowed ₦33.64bn and paid ₦27.54bn as debt service.

Bayelsa state got ₦57.85bn IGR more than its revenue target of ₦23.87bn. It spent ₦75.23bn on its operating costs and spent ₦30.54bn on its debt service.

Governor Hyacinth Alia of Benue state approved the spending of N29.45bn for operating expenses while it collected ₦8.71bn as revenue out of an N23.91bn target. This state didn’t borrow but spent ₦5.48bn to service previous loans collected.

Similarly, Cross Rivers spent ₦55.73bn on recurring expenses, collected ₦32.42bn IGR, borrowed N20.67bn from its creditors and spent ₦19.99bn on debt service.

Delta state recurrent expenditure reached ₦121.54bn in nine months while it earned N97.02bn as revenue out of the ₦110.3bn target. The oil-rich state serviced its debt with N55.9bn and didn’t obtain any loan.

Also, Ebonyi State spent ₦37.73bn on its recurrent expenses but earned ₦15.67bn as revenue. The state borrowed ₦15.65bn and spent N8.46bn on debt service.

Edo State spent ₦75.78bn on recurrent expenditure but generated ₦52.68bn revenue. The state borrowed ₦12.84bn and spent ₦27.5bn on its debt service commitments.

Similarly, Ekiti State recurrent spending was ₦74.73bn, generated ₦23.16bn revenue, borrowed ₦11.75bn and spent N12.93bn to service its debts.

Enugu State spent ₦10.88bn on its operating expenses but got N39.98bn in revenue. This state borrowed ₦1.39bn and spent ₦6.93bn on its debt service.

Imo State under Governor Hope Uzodinma, spent ₦42.75bn on its operating expenses but got ₦15.24bn as revenue. This state spent ₦15.94bn to service its debts but didn’t obtain any loan.

While Jigawa incurred N35.69bn as operating expenses, it collected ₦18.41bn as revenue out of its target of ₦50.65bn borrowed ₦744.75m, and ₦2.17bn on debt service.

Further analysis showed that Katsina State spent ₦40.73bn on its recurrent expenditure while it generated revenue of N29.95bn. This state increased its loan by ₦72.89bn and paid ₦12.78bn as debt service.

Kebbi state recurrent spending was ₦22.42bn while it generated ₦7.86bn revenue. It also obtained an N24.59bn loan and paid debt service of ₦3.42bn.

Kogi State spent ₦84.48bn on its operating expenses but earned ₦19.86bn in revenue. The confluence state also obtained ₦51.68bn as loans and repaid ₦18.12bn debt.

Lagos state spending on recurrent expenses was ₦375.19bn, while it earned ₦912.15bn revenue. The state paid ₦84.53bn as debt service but didn’t obtain any loan.

Within the same period, Nasarawa spent ₦42.63bn on its operating expenses but got ₦22.78bn as revenue, Niger state recurrent expenses reached ₦41.28bn while it earned ₦29.22bn.

Ondo State spent ₦107.34bn on recurring expenses but only earned ₦24.43bn, Osun State spent ₦48.87bn but earned ₦28.86bn as revenue while Oyo State spent ₦51.24 on its recurrent expenditure, ₦45.79bn was collected as revenue.

Plateau spent ₦144.86bn on its recurring expenses but only earned ₦18.03bn; Rivers State’s spending on its operating costs was ₦72.69bn, but it earned ₦269.17bn.

Taraba state spending on recurrent expenditure reached N58.39bn, surpassing its revenue generation of ₦7.84bn, resulting in a deficit of N50.55bn. This state borrowed N52.63bn and paid ₦21.19bn.

Yobe State spent ₦51.29bn on its recurrent costs but earned ₦8.14bn as revenue. Also, Zamfara spent ₦36.34bn on its recurrent expenditure but earned ₦18.46bn.

Commenting in an interview, A professor of Economics at Babcock University, Segun Ajibola, stated that the enduring problem of high governance expenses had persisted at the state level, with inadequate oversight and accountability resulting in minimal economic benefits for grassroots citizens.

Ajibola, a former president of the Chartered Institute of Bankers, lamented that state assemblies had also abandoned their oversight duties, leaving the state governors to operate with no iota of transparency and accountability.

The Fiscal Responsibility Commission last week expressed concerns over Nigeria’s current fiscal federalism structure, cautioning that the system may be unsustainable in its present form.

Credit: punchng.com