Reasons are coming up why the oil refinery being built in Lagos by Dangote Group may not start production until 2022, two years later than the target date.

Reuters quoted sources with direct knowledge of the matter as saying this in a report on Friday.

The 650,000 barrel per day refinery, set to be Africa’s biggest, is expected to boost Nigeria’s growth and turn the country from an importer of refined products into an exporter.

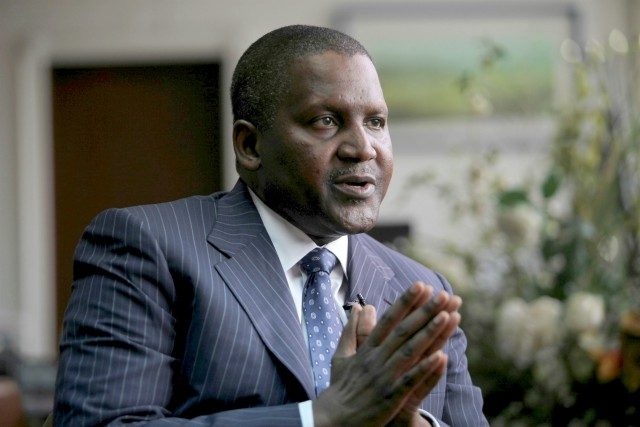

Africa’s richest man, Aliko Dangote, told Reuters last month that he hoped to finish building the refinery in 2019 and to start production in early 2020.

However, the sources, who were said to have been on the site many times, said they did not expect petrol or diesel output before early 2022 and even then, many units at the refinery and accompanying petrochemical plant would not be complete.

The Executive Director, Dangote Group, Devakumar Edwin, who oversees the project, described the suggestion that the refinery was unlikely to start production until 2022 as the product of “someone’s wild imagination”.

“Ninety-five per cent of engineering has been completed; 90 per cent of procurement has been completed.”

“We started civil works in July last year and we have scheduled two and a half years for mechanical completion,” he said, referring to the point where a plant is ready to be handed over for inauguration.

Dangote, who expects the project to cost $12-14bn, said in July he had raised more than $4.5bn.

“I’ve never seen a refinery of that scale built in two years. It’s highly improbable due to the sequence of events that need to happen; it cannot be fast-tracked safely,” one of the sources advising the Nigerian government said.

The sources said a refinery on such a scale would likely need five years to complete and the piling underpinning the plant had only started in the second half of last year and would take some more months to complete.

Extra piling was needed to support the plant’s units in the swampy area, causing an unforeseen delay, the sources said.

Analysts also anticipate delays owing to the scale of the project in an area with limited infrastructure.

“In our forecast, we are putting late 2021 at the earliest for some petrol production but it may slip to 2022,” said Gary Still, executive director of CITAC, a specialist consulting company focused on African downstream energy.

Fuel shortages are common in Nigeria, despite the country of 180 million people being Africa’s biggest oil producer.

The existing 445,000 bpd refining system operates well below capacity due to corruption and lack of investment, leaving the state oil firm to import the bulk of its petrol and diesel needs paid for with cargoes of crude oil.

Edwin told Reuters last month that more than half the plant’s output could be exported after covering domestic needs.

Credit: punchng.com