Stakeholders from across sectors and agencies on Tuesday unanimously agreed that illicit financial flows (IFFs) remain a critical drain on government’s generable revenue and thus called for urgent concerted effort to tackle the menace.

The stakeholders spoke at the opening of a two-day national conference on IFF organised by the Federal Inland Revenue Service (FIRS) with the theme: “Combating IFFS: Strengthening Nigeria’s Domestic Resource Mobilisation” and held at Transcorp Hilton, Abuja.

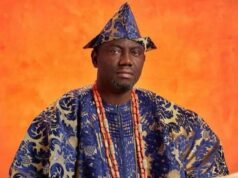

FIRS chairman, Zacch Adedeji, in his welcome address, charged participants drawn from within and outside the country to use the conference to bring about the needed constructive collaboration to stop IFFs and consequently revitalise the country’s fiscal landscape.

Adedeji, according to a statement by his Special Adviser on Media, Dare Adekanmbi, described IFFs as one of the most critical challenges facing the country’s economy.

“Illicit financial flows through tax evasion, profit shifting, money laundering, and trade mis-invoicing do not merely represent financial wrongdoing. They constitute a structural drain on our economy, depriving us of the resources needed for inclusive development.

“Each unaccounted dollar undermines governance, erodes trust, and translates into lost infrastructure, inadequate public services, and deepening inequality.

“The scale of these flows, especially through aggressive tax avoidance by multinationals exploiting opaque global arrangements, continues to threaten Nigeria’s fiscal stability.

“Like many other resource-constrained nations, we lose billions annually through these illicit conduits—making this conference not just a policy dialogue, but a national imperative.

“Under President Bola Tinubu’s Renewed Hope Agenda, we have entered a new era of fiscal reform. The recent assent to four tax reform bills on June 26, 2025, signals this administration’s strong commitment to overhauling our tax system, modernising the legal framework, and institutionalising transparency in revenue collection.

“But legal reform is only a starting point. To deliver on its promise, we must reinforce enforcement, optimise digital compliance, and build public trust through fairness, predictability, and strategic communication.

“At FIRS, we are responding with a deliberate, multi-dimensional strategy. First, we are championing voluntary compliance by promoting taxpayer education and simplifying systems. Our goal is to foster a culture where compliance is driven by trust, not fear.

“Second, we are harnessing technology and intelligence. We have launched an ambitious digital transformation programme, including the establishment of a Tax Intelligence and Automation Department.

“With real-time analytics, integrated third-party data, and anomaly detection, we are building a tax system that is proactive, smart, and secure. This is not just about digital infrastructure—but digital vigilance.

“Third, we recognise that combating IFFs demands collective action. As the designated coordinating agency under the Proceeds of Crime Act (2022), FIRS has established the Proceeds of Crime Management and Illicit Financial Flows Coordination Directorate. This unit is leading implementation efforts, supporting asset recovery, and coordinating with law enforcement agencies, the judiciary, private sector actors, and international development partners,” he said.

In her remark, the chairman of the conference and Minister of State for Finance, Dr Doris Uzoka-Anite stressed the need to protect and retain the wealth generated within the country’s borders.

“It is estimated that Nigeria loses $18 billion annually to IFFs due to profit shifting and aggressive tax avoidance practices by some multinational corporations transacting businesses in Nigeria.

“Huge sums of money are transferred out of the country which strips the country of resources that could be used to finance much-needed public services.

“We must not lose sight of this as there are so many foreign companies transacting in Nigeria without paying adequate taxes. A lot of the international tax treaties that Nigeria has entered do not presently reflect our renewed resolve for tax equity. This needs to change.

“Hence there is a need to bring them in conformity with our current economic realities, the new tax reforms regime, and towards tax equity between the global North and the global South,” she said.

While acknowledging the recent tax laws as a demonstration of President Tinubu’s commitment to fiscal reforms, the Minister called for alignment of policy and enforcement across agencies as laws alone would not be enough.

She commended FIRS for leveraging technology to enhance its operational capacity, “making it increasingly difficult for companies and individuals to manipulate financial records or conceal taxable income.”

Ugandan lawyer and member of the Thabo Mbeki High Level Panel on IFFs from Africa, Honorable Irene Ovonji-Odida listed the challenges facing Africa in the effort to address IFFs as including the need to strengthen capacity and coordination of Africa, establish global coherence of what has been agreed by Africa.

She noted that estimates of IFFs from Africa have grown cumulatively to about $1trillion over 50 years, saying West Africa of which Nigeria is a critical part, and North Africa lost about $407billion from trade mis-invoicing in 10 years.

The right activist said tax avoidance through commercial activities accounted for 65 per cent of IFFs, while criminal activities were responsible for 30 per cent with corruption through bribery of government officials accounting for five per cent.

Ovonji-Odida accused the Western powers of complicity in IFFs from Africa through shaping the rules of the key sectors which she said were often “opaque and unaccountable.”

“Indeed, the systems of key professions such as Law, Accounting, Audit, Banking, and other financial sectors are derived from Global North countries and, by shaping the very ethos and rules of important actors and activity within national and global economies, further entrenches the overall western thrust of the global economic and financial systems.

“Africa needs to continue to develop its common negotiating position on global tax reform and through south-south cooperation, build a global south position, in the United Nations negotiation process,” she suggested.

In a goodwill message, the Comptroller General of Customs, Bashir Adeniyi recalled how the agency impounded $8.3 million which was to be taken outside the country only for the Financial Action Task Force (FATF), a global anti-money laundering and terror financing body, to react that it was more interested in the money coming in the Nigeria and leaving the country.

“But then what we do in the enforcement environment is to ensure that the 30 per cent do not become 50 percent of illegal financial flows or possibly reverse the trend. And in the Customs, what we do daily is to monitor illegal cross border movements of finance either in cash or in some other instruments.

“We have a protocol that says once cash goes beyond a threshold it must be declared. This conference is indeed very timely because in the next few months we are going to be playing host to the Financial Action Task Force to cross check our readiness for assessment.

“It is obvious that the whole of society approach is necessary because of the complexity of IFFs. So, Customs, the tax authorities, the enforcement agencies, EFCC and all of us must work together in a collaborative manner.

“The major problem, a very big one in Nigeria, is associated with illegal mining and how the proceeds of mining cross our borders. And recently, the United Nations Office on Drugs and Crime (UNODC) has been of help. I’m happy that they are also participating in this conference.

“In Lagos Airport, when I was the area comptroller in Murtala Muhammed Airport, we made one single seizure of about $8.3m. And we discovered that FATF was never impressed with these seizures.

“We asked questions during one of the sessions and they said they are more interested in the inward movement of cash. We are still asking questions. Up till now, we have not found the right answer to this question,” he said.

Packaged by Alice Egbedele